![barack obama victory confetti]()

I’ve gotten a few questions on the 2012 US electionand how the results – another 4 years of Obama – will impact the finance industry.

While I had fun writing the Occupy Wall Street post last year and pissing off a whole lot of people reading it (but mostly random visitors who wanted to complain…), I haven’t had the chance to do anything like that this year.

So let’s get started.

First, I’ll admit who I voted for and why… and then we’ll get into the implications of the election both for the economy as a whole and for the finance industry specifically.

The Truth

I was exceptionally unenthusiastic about either candidate, even more so than in 2008.

Generally, I am in favor of smaller government and less spending on entitlements – mostly because, as we’ll see below, the US is going bankrupt and simply CANNOT afford its current spending levels anymore.

My position has nothing to do with ideology – after all, there should be a “social safety net” in the richest country on Earth – and is 100% related to the finances of the US instead.

I look at what’s going on in Europe right now and say, “I do NOT want this country to end up like Greece or Spain – even if it means some short-term pain.”

On the other hand, I found it difficult to get behind Romney’s “Cut taxes by 20% and… we’ll grow the economy by so much that we’ll reduce the deficit!” logic.

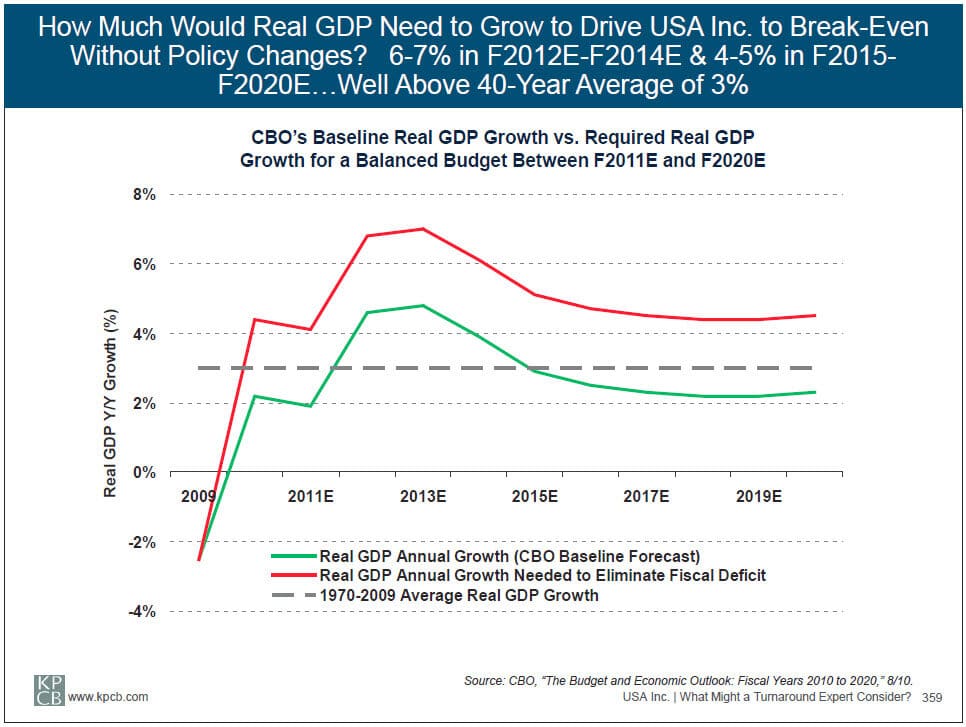

If you do the math you’ll see that it’s completely impossible to reach the “break-even point” unless the US GDP grows at 6-7% this year and next and then 4-5% after that for years – in other words, completely impossible growth rates that are more in-line with emerging markets than this country.

Oh, and this is without those 20% tax cuts:

![us-election-01]()

What we need to do to fix the fiscal problems is straightforward, but nearly impossible to implement: raise taxes AND cut spending and restructure programs like Medicare and Medicaid.

Liberals, of course, want to raise taxes and increase spending, while conservatives want to cut taxes and cut spending, with both groups unwilling to acknowledge that a compromise is needed.

And then they create gridlock in Congress and prevent anything substantial from ever getting done.

My Vote Went to…

Taking into account two candidates that I was extremely unenthusiastic over, I was able to make my decision very easily… but she was a bit of a “dark horse” candidate (or should that be “dark dragon” candidate)?

Yes, that’s right: Daenerys Stormborn is clearly the best choice to lead the country.

The public is unwilling to accept higher taxes? Or reduced government spending?

Just unleash one of those 3 dragons and you can instantly solve a bunch of problems.

Unleash all 3, and we wouldn’t even need a government to do anything.

The fact that I live in New York State, where my vote is completely irrelevant, also made it easier to go with such a bold and unexpected choice.

In All Seriousness

No, I didn’t actually vote for a fictional character from Game of Thrones, but I was very tempted to do so.

What I wrote above is just the tip of the iceberg of what I’ve been thinking about over these past few months; both parties had so many laughable positions, promises and “policies” that it really did feel like we were living in a fantasy kingdom with a Mad King who burns his enemies alive.

I am deeply concerned about the direction of the country, and I don’t think much of what was proposed by either candidate will fix anything.

Why No Policy Will “Fix” Economic Growth

There has been a ton of debate over tax policies and other government decisions, but all of this discussion ignores one simple truth: the president has limited power to “fix” the economy and macroeconomic / industry trends matter FAR more than policy decisions.

Yes, the economy boomed under Bill Clinton in the 1990′s and he balanced the budget… but how much of that was due to the IT revolution and the Internet vs. his own policies?

The biggest problem with the economy today is that there’s too little investment into “empowering” innovations that actually transform industries and/or create entirely new industries – which means that new jobs are barely being created, regardless of what the tax rate is.

See “A Capitalist’s Dilemma” for more on this one.

A secondary, but related, problem is that companies that employ hundreds of thousands of people simply aren’t being created anymore.

Technology and automation have made everything so much more efficient that the kind of labor force that was required in the 1950s – 1980s is no longer needed.

For a simple example, consider a business like this site and BIWS: getting to this level with a relatively small team would have been impossible 50 years ago.

Back then, I would have needed more like 40-50 people to run everything: someone to manually input transactions, trainers to go teach classes in-person, someone to print out and deliver newsletters on paper, someone to manually call customers on their land-line phones… and damn, Excel didn’t even exist.

So much of that has been automated and streamlined that the net impact is that even new, highly successful companies simply don’t create that many new jobs.

This is one of the reasons why each recovery since the 1980s has taken longer and longer and why the current “recovery” is so anemic.

And then you have other factors, like the shift from full-time or part-time “employment” to more and more contractor work, outsourcing many functions overseas, and more.

The bottom-line: I don’t think the official unemployment rate will drop back to “normal” levels of 4-5% anytime soon– regardless of who’s in office or what tax rates are.

Read more about this topic here.

How to Fix the Country

What would your “investment recommendation” be if you were analyzing a company and its annual cash flows looked like this graph below?

![us-election-02]()

You would say, “Do NOT invest – stay far, far away unless you’re a turnaround / restructuring expert.”

And yes, that graph is the true financial profile of the USA as outlined in the excellent USA Inc. report from last year.

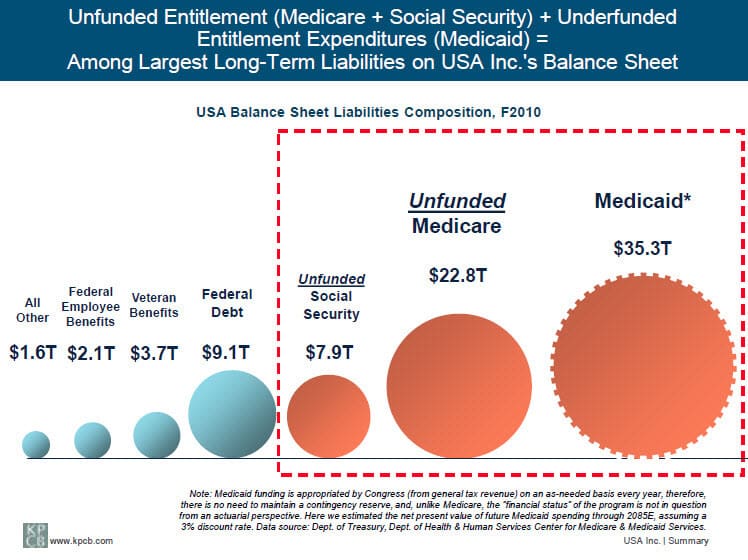

If you drill down into the data, you’ll see the primary reasons for the US fiscal problems: Medicare and Medicaid, combined with lower tax revenue.

If you’re outside the US and are unfamiliar with these, Medicare is a guaranteed health insurance program for citizens over the age of 65, while Medicaid is a guaranteed health insurance program for families with low income and resources.

Forty years ago, combined spending on these programs comprised 5% of total expenses in the US; today they represent 21% of all spending.

To give you an idea of the problem this presents, here’s what the Liabilities on our “Balance Sheet” look like:

![us-election-03]()

But here’s the punch-line: by 2025, if left unchecked, entitlement spending plus interest payments will exceed TOTAL revenue – leaving no room for spending on anything else, and ultimately bankrupting the country:

![us-election-04]()

While spending in other areas arguably needs to be cut or tweaked, Medicare and Medicaid make the US fiscal situation completely unsustainable– primarily because:

- Healthcare costs have risen at twice the rate of inflation over this time period;

- The number of people enrolled in these programs has skyrocketed, jumping from 12% of Americans in the 1960′s to 31% now;

- And, to be blunt, Americans are extremely unhealthy and “suffer” from many completely preventable “conditions,” like obesity (see pg. 112 of USA Inc. for more).

These are complex problems and I don’t have all the solutions.

But any solution will have to involve both increasing revenue and cutting expenses – the 3 most important points are:

- Raise Taxes– And it needs to be more comprehensive than the “Make The 1% pay even more!” line of reasoning. Yes, that will help a little… but as Michael Arrington points out, one huge problem right now is that “stored up wealth” is not being taxed at all. Should there be a “wealth tax”? Maybe, if it could somehow be used to encourage long-term investment in industries that won’t yield an immediate profit or ROI in 3-5 years. Maybe the solution is increasing tax rates, or maybe it’s expanding the tax base, or maybe it’s some combination of both.

- Reform Healthcare– Rather than making slight tweaks to this one, I believe something far more comprehensive is needed. The US system should be more like the healthcare system in Singapore, one of the most successful systems in the world. The main idea there is that everyone is forced to divert some pay into private healthcare savings accounts, which they then must draw on, at least partially, to pay for medical expenses. Nothing is “free,” which prevents the over-utilization that you see in places like Canada and the UK. I did mention that 60% of Medicaid spending goes to “optional recipients,” right? (see pg. 15 of the USA Inc. report).

- Encourage Long-Term Investment in New Industries– Perhaps you do what the “Capitalist’s Dilemma” article recommended and introduce 0% “super-long term” capital gains tax rates for investments held for 8-10 years or more, or provide some other type of incentive for investing in transformative industries that would actually create jobs. Alternative energy is one of the most likely candidates here, but there may be others.

Yes, we should have a “social safety net” and programs like Social Security should continue to exist.

I am not one of these crazy Tea Party people or “Libertarians” or Rick Perry arguing that it’s a “Ponzi scheme.”

I agree and disagree with both parties on many issues and don’t follow a particular “ideology” other than “Do what works and even if a solution seems crazy on the surface or is extremely unpopular, implement it if it solves the country’s problems.”

So my motivation for all the points above is not about ideology, but rather making the numbers work.

Will Any of This Happen?

If the past few years are any indication, the answer is a resounding no.

There’s way too much gridlock in Congress and no one is willing to acknowledge that entitlement programs need to be radically altered, not just tweaked slightly.

So I am quite pessimistic about the future of the country and the possible resolution of these fiscal problems.

I think the US credit rating will continue to be downgraded as the deficit and debt grow, and that, if left unchecked, the country will be on the path to bankruptcy within 15 years.

The only options to “solve” it are: 1) The government introduces massive inflation to pay off its debt; 2) Entitlements are completely gutted, resulting in panic and death; 3) They intelligently rework the tax code and healthcare system (I would put the odds of this one at 0.01%).

Options #1 and #2 would result in apocalyptic scenarios transpiring, but unfortunately they’re the most likely outcomes at this stage.

So in predicting how the finance industry will be affected, I’ll continue to assume that these problems will get worse, not better, because the “general public” (people who haven’t read USA Inc. or who don’t understand it) hasn’t even grasped the scope of these issues yet and how screwed we all are.

The Impact of the Election on the Finance Industry

Four years ago I predicted the impact on take-home pay based on Obama’s victory; this time around I’m not even going to attempt to do that because his proposals were vague other than the “Increase taxes on those earning above $250,000” line.

The bottom-line is that your take-home pay is going down by at least 5-10% because of that pledge, the “fiscal cliff,” and the new taxes that will come into effect as a result of Obamacare.

At the very minimum, the top 2 federal tax rates are increasing from 35% and 33% to 39.6% and 36%, respectively, assuming that the Bush tax cuts expire (which seems likely, at least for these top brackets).

Then you have increases in the capital gains and dividends taxes, the payroll tax increase, and a whole bunch of other increases; you can get a summary here.

The most relevant quote: “The top 1 percent of households face some of the largest tax increases in 2013 and would see their after-tax incomes fall by 10.5 percent if Congress does nothing.”

“The top 1 percent” here refers to almost everyone above the entry-level in the finance industry because of the income threshold; we’re looking at everyone beyond the $200,000 USD per year income level.

So yes, your taxes are going up – maybe by slightly less than 10% if you’re just starting to work full-time, but certainly by some amount.

But everyone expected that. The more interesting question is which industries will be impacted not only by his victory, but also by the looming fiscal disaster in the country.

I don’t have all the answers, but here are a few industries that come to mind:

Healthcare– Some people seem to be optimistic about the healthcare sector because now companies will have more customers as a result of Obamacare.

I think the impact will depend on the specific sector; it might help pharmaceuticals, insurance providers and hospitals, but it seems likely to hurt medical device manufacturers due to the 2.3% tax on all sales of medical devices (that’s sales, not profits – ouch ). In fact, it has already resulted in layoffs and planned layoffs in the industry.

Some consolidation and M&A activity will probably result from all this, but the overall impact on healthcare depends greatly on the sector you’re in, and I am not too optimistic personally.

See more on healthcare investment banking and key drivers.

Real Estate & Home-Building– On one hand, the Obama administration has been very friendly to these companies because of “quantitative easing” (don’t even get me started there…) and the ripple effect that real estate has on the economy – and these stocks have outperformed the market as a whole over the past few years…

But then you look at an economic downturn that’s likely to continue, unemployment that may actually get worse, and consumer spending that may decline further as everyone deleverages and it’s hard to see positive trends in office, residential, or retail properties.

But real estate does have one big thing going for it: even in an apocalyptic scenario where the US government goes bankrupt and civilization ends, buildings and land still have some value.

See more on real estate investment banking and the key drivers.

Technology– There haven’t been too many new policies here and there probably won’t be going forward, and trends such as cloud computing and mobile devices will continue.

The most likely impact within the finance industry is not on the overall technology sector, but rather on specific verticals within it.

Healthcare IT, for example, may see a boom because of all the new regulations that make it even more important for companies to automate record-keeping and reduce the compliance burden.

We saw the same thing after Sarbanes-Oxley was passed in 2002: companies offering technology-based solutions for compliance started to spring up and get acquired by bigger players.

See more on technology investment banking and the key drivers.

Mining– Here’s where we might see the real “boom.” A falling USD (and other major currencies losing their value) plus possible runaway inflation mean that investors will sink even more funds into gold and other minerals… further pushing up prices and deal activity.

Learn more about metals & mining investment banking right here.

So, in short: if you don’t know what investment banking group you want to work in, mining just might be a great choice with the election results and the looming apocalypse. Other natural resource sectors, such as oil & gas, may also see a spike in deal activity if commodity prices there increase.

Many other sectors, such as consumer/retail, industrials and clean-tech could be anywhere from “neutral” to “bad,” depending on the overall economy and the specific sub-industry you’re in.

So, What Should You Do With Your Money?

I don’t give “investment advice” on this site, partially because it would get me in trouble and partially because I don’t do much public markets investing myself.

But I’ll make an exception here and give some simple advice: diversify out of the US Dollar and outside of the country.

You should think of your investment strategy in these terms: “In the case of a continued US government credit rating decline, possible bankruptcy, and global apocalypse, what assets would still have value?”

Three that come to mind are commodities, real estate, and agriculture.

Depending on how pessimistic you are, you may want to add weapons to that list as well; bullets apparently last forever and they might just become the currency of choice in the future.

While commodities like gold don’t have much value on their own, other metals and minerals and energy resources will still prove useful and have some value even if everything else collapses.

And agriculture is an overlooked but extremely promising sector – we’ll actually be publishing an interview with a reader who works in agricultural finance in the near future.

Let’s just say that it’s one of the few areas where you can get high returns with minimal leverage. And if humans continue to exist, they’ll still need to eat something to survive.

For Further Learning

My #1 recommendation is Mary Meeker’s excellent USA Inc. report, published last year.

This erases all the hype about what’s going on with the US fiscal situation and uses REAL numbers to show what’s happening.

You may disagree with the recommendations or you might be more optimistic than she is, but the report is 100% required reading if you want to understand the dire straits the US is currently in.

Also check out Rumble 2012: Jon Stewart vs. Bill O’Reilly– a debate between two talk show hosts that was far more entertaining, informative, and arguably even more honest than the actual “debates” during this election season.

To learn more about why the healthcare system in the US is broken and why the one in Singapore works so well, check out The Undercover Economist.

Please follow Clusterstock on Twitter and Facebook.

Join the conversation about this story »

"I think when you talk about financial services, our industry -- or any industry -- can benefit from the high moral standards and commitment from these returning veterans. It can't help but be a good thing. We strongly believe our returning veterans can do that not only for Academy, but for the financial services industry and our economy as a whole," Academy Securities' president Phil McConkey told Business Insider.

"I think when you talk about financial services, our industry -- or any industry -- can benefit from the high moral standards and commitment from these returning veterans. It can't help but be a good thing. We strongly believe our returning veterans can do that not only for Academy, but for the financial services industry and our economy as a whole," Academy Securities' president Phil McConkey told Business Insider.